DNA testing is a great way to learn more about a dog or cat and understand their genetic risk for certain health conditions. However, this proactive step has caused some to wonder if genetic test results will impact a pet’s eligibility for insurance coverage. So, let’s dispel these concerns and break down how pet insurance commonly works.

Does genetic testing impact insurance eligibility?

Some people worry that uncovering genetic health risks might make pets ineligible for insurance coverage or subject to higher premiums. The good news is that while pet insurance companies do ask for information on pets that are applying for coverage, genetic test results are not typically part of the application process. Rather, insurance companies gather information on a pet’s age, breed, and health history, including any diagnoses or procedures a pet has had in the past.

The concern around genetic testing and insurance eligibility is therefore likely linked to confusion between genetic predispositions and pre-existing conditions.

What factors play a role in insurance coverage?

It’s important to remember the differences between a pre-existing condition and a genetic predisposition. A pre-existing condition is a health issue or injury that a pet has either been diagnosed with by a veterinarian or is showing signs of before an insurance policy takes effect.

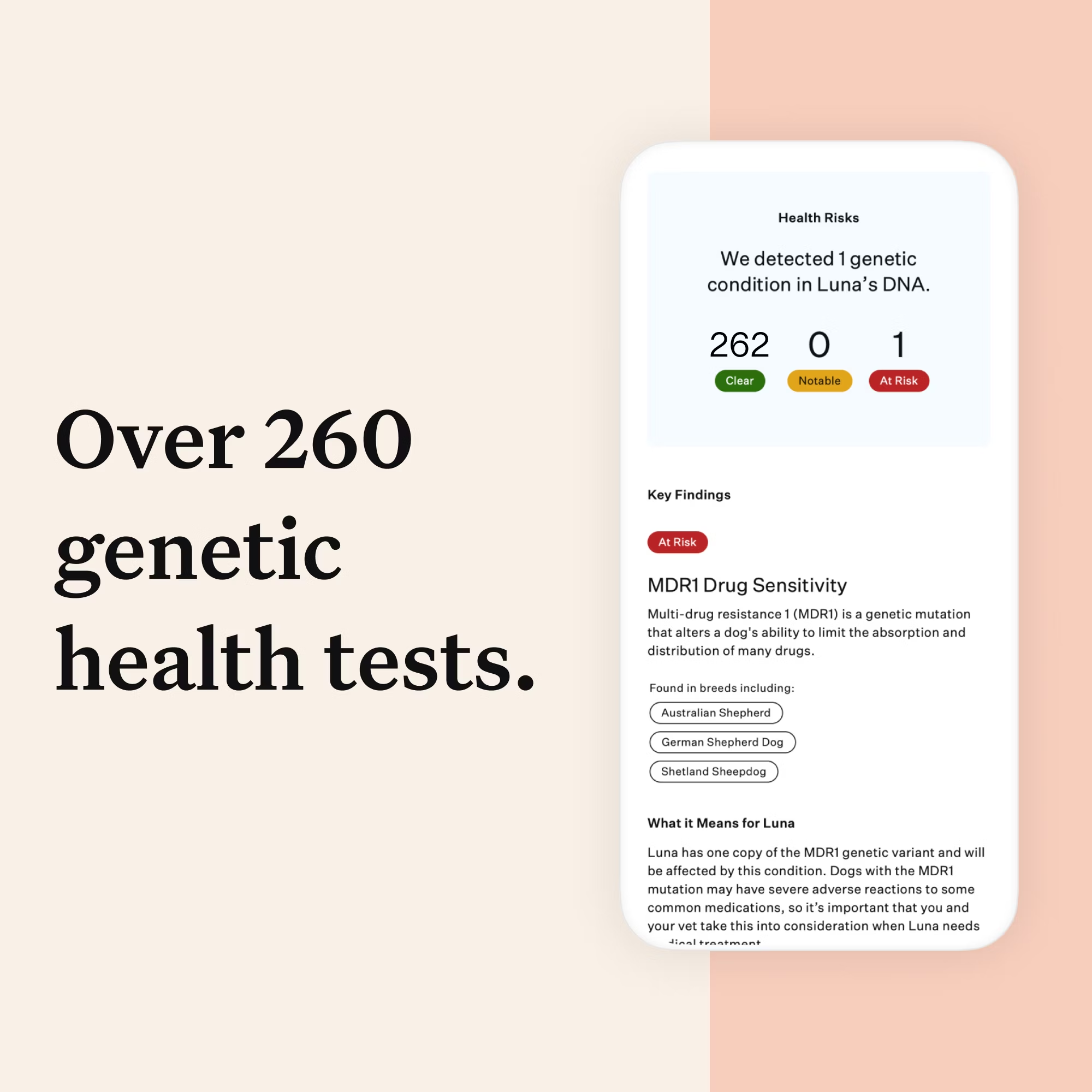

Genetic predispositions, on the other hand, mean a pet is at-risk of developing a certain condition. It does not mean that a pet is showing any signs of the condition or that a pet has been diagnosed. A pet may or may not go on to develop the health condition. Any diagnosis that an insurance company would factor into a pet’s eligibility would come from a veterinarian after performing an exam and any necessary testing, not from the results of a DNA test—even if that DNA test is done by a veterinarian and is part of a patient’s medical record.

What does this mean for pet owners seeking coverage for their pets? In a nutshell, pre-existing conditions can affect coverage and premiums, while genetic predispositions generally do not. That’s because an insurance company’s primary concern is not what might happen based on a pet’s genetics, but rather what has already occurred in the form of pre-existing conditions.

How does pet insurance typically work?

Pet insurance offers peace of mind and provides some relief against unexpected veterinary expenses. Policies typically cover accidents, illnesses, and sometimes even preventive care, depending on the plan you choose. Following are the basic principles of how most pet insurance is structured.

Premiums, deductibles, and coverage limits: Pet insurance policies come with monthly premiums, deductibles (the amount you pay out-of-pocket before coverage kicks in), and annual coverage limits. These factors can vary widely based on the provider, the age and breed of your pet, and the level of coverage selected.

Waiting periods: Most policies include a waiting period from the start of the policy to when coverage begins. This is to prevent claims for conditions that occur immediately after obtaining the policy, as those may be indicative of pre-existing conditions.

Reimbursement model: Pet insurance typically operates on a reimbursement model, where you pay upfront for veterinary services and submit a claim to your insurer for reimbursement. The percentage of the cost covered after the deductible varies by policy.

Partnering together on genetic testing

As with anything involving pets, it’s important for pet owners to do their research. Before they select a pet insurance policy, veterinarians should advise clients to compare coverage options, exclusions, and how the company handles pre-existing conditions. By working together with pet owners, veterinarians can play a role in ensuring they have the right pieces in place to manage the lifelong care of their pets.